From Compliance Burden to Cybersecurity Edge

Leveraging AI Regulations as a Differentiator

‘Compliance' and 'competitive advantage' rarely appear in the same sentence for cybersecurity leaders. A growing number of organizations are transforming regulatory burdens into strategic weapons. As global regulatory AI frameworks become increasingly complex and divergent, the choices for organizations are limited: treat compliance as a box–ticking exercise or embrace it as a strategic lever that can bolster security operations, amplify trust, and create tangible competitive advantages. I make no secret that I am about to advocate the latter.

Far from being just another overhead cost, regulatory compliance can offer the cyber leadership a unique chance to strengthen their security posture while proactively managing evolving risks. Regulations that demand explainability, transparency, and fairness may initially seem restrictive, but these mandates can drive clarity, sharpen accountability, and enhance resilience across the organization.

Here I will attempt to unravel how visionary organizations are already harnessing compliance requirements to build stronger, more adaptive security frameworks. By transforming regulatory mandates into operational opportunities, security leaders can leverage compliance as a business enabler, not just a legal obligation. In the sections ahead, I’ll explain how strategic compliance can become your organization's cybersecurity edge – turning complexity into capability, risk into resilience, and obligation into advantage.

The stakes are tangible: organizations that treat compliance as a mere checkbox exercise risk not only regulatory penalties but also missed opportunities to strengthen their security posture. Those who approach regulation strategically; however, can transform compliance from a burden into a catalyst for trust, transparency, and competitive advantage.

Navigating the Compliance Maze – 3 Key Challenges Facing Security Leaders

Deploying AI-powered cybersecurity across global jurisdictions means grappling with regulations as complex and dynamic as the threats themselves. While every region introduces its unique blend of rules – whether the EU's strict AI Act, America's fragmented sectoral regulations, or China's state–driven AI governance – several key compliance challenges universally confront cybersecurity teams. Understanding these obstacles is the critical first step in transforming regulatory compliance from a perceived burden into a strategic asset.

Three core issues – Explainability, Cross-border Data Flows, and Third-party AI Risk Management – consistently emerge as key themes across these different regulatory frameworks. Not only are they foundational to achieving compliance in multiple jurisdictions, but they're also uniquely impactful in shaping the operational effectiveness and resilience of AI–driven cybersecurity programs. Failing to address any one of these key challenges can expose organizations to substantial regulatory, reputational, and operational risks – making them essential focus areas for cybersecurity leaders aiming for strategic compliance.

Challenge 1: The Explainability Imperative

As regulatory demands for transparency rise, AI systems must now explain their decisions clearly, consistently, and in human-understandable terms: no small feat for complex neural networks trained to detect subtle, high-dimensional security anomalies. Explainability is no longer just a technical nice-to-have; it’s a compliance obligation and a business risk. For security operations, this introduces tough trade-offs between model performance, intellectual property protection, and regulatory accountability. The real-world impact: teams must generate detailed audit trails and decision rationales for AI-driven alerts: adding operational overhead and potentially slowing response times, especially where explainability was not considered during system design.

Challenge 2: The Cross-Border Data Dilemma

AI-driven cybersecurity relies on large-scale, diverse data sources – logs, behaviours, threat intelligence – often collected across global infrastructure. But as data sovereignty laws like the EU’s GDPR and China’s PIPL tighten cross-border data controls, organizations face a critical tension: global visibility versus local compliance.

Efforts to regionalize data to meet legal requirements can fragment security architectures, limit threat model accuracy, and reduce detection precision. Security teams must now design architectures that reconcile regulatory fragmentation with the operational need for unified situational awareness. This is an increasingly complex balancing act.

Challenge 3: Third-Party AI Risk Management

Using third-party AI platforms no longer limits liability, it extends it. Regulators increasingly hold organizations accountable for the behaviour of external AI systems, even those they don’t build or directly control. This raises the stakes for cybersecurity and risk teams, who must now conduct rigorous due diligence across the entire vendor lifecycle. From data sourcing and model validation to explainability, monitoring, and incident response readiness, the governance burden has shifted sharply to the end user. As AI supply chains expand – often including fourth-party dependencies – managing third-party risk becomes not only more complex, but more critical to maintaining both compliance and operational integrity.

Each of these challenges brings real operational pressure – added complexity, higher costs, and new layers of accountability. But when approached strategically, these same regulatory demands can become powerful levers for innovation, resilience, and competitive advantage. In the next section, we’ll explore how forward-thinking organizations are doing exactly that – transforming compliance constraints into catalysts for stronger, smarter cybersecurity.

From Roadblocks to Runways - Turning Compliance Challenges into Operational Opportunities

While compliance obligations tend to be viewed as obstacles to creative processes and operational efficacy, visionary leaders should view them as powerful catalysts for operational innovation. Each regulatory challenge outlined previously – whether it's model explainability, cross–border data flows, or third–party risk management – offers unique opportunities to enhance cybersecurity capabilities and resilience. Turning the regulatory burden into strategic differentiators.

Rather than passively adapting to regulatory demands, organizations should leverage these challenges as moments for strategic improvement. In the following cases, we'll demonstrate how leading cybersecurity teams have successfully turned what initially seemed restrictive into tangible operational strengths. These real–world examples underscore how a thoughtful approach to compliance can drive innovation, improve efficiency, and ultimately strengthen security posture.

The Explainability Imperative: From Burden to Advantage (challenge 1)

With EU’s AI Act becoming enacted, a European financial services firm faced a daunting new requirement: providing detailed explanations for every AI–driven security alert. The security operations team, already overwhelmed with thousands of daily alerts, feared explainability would drastically slow operations. Initially, the operations team estimated a 40% increase in analyst workload and significant delays in incident responses – risks and costs they couldn’t afford.

The Strategic Pivot: Rather than layering explanations onto existing systems, the team embraced "Compliance by Design," integrating explainability from the ground up and as a non–functional requirement from the start. They engineered a hybrid AI architecture, combining deep–learning models (for detecting subtle threats) with transparent decision–tree models (for generating clear, audit–friendly explanations) validated though several steps of model governance and risk reviews.

“We created a system where one part detects threats and another simultaneously explains why they matter,” the SOC Manager explained. The AI now generated standardized explanations outlining anomalies, baseline comparisons, key factors, and confidence metrics, supported by intuitive visualizations understandable by junior analysts and auditors.

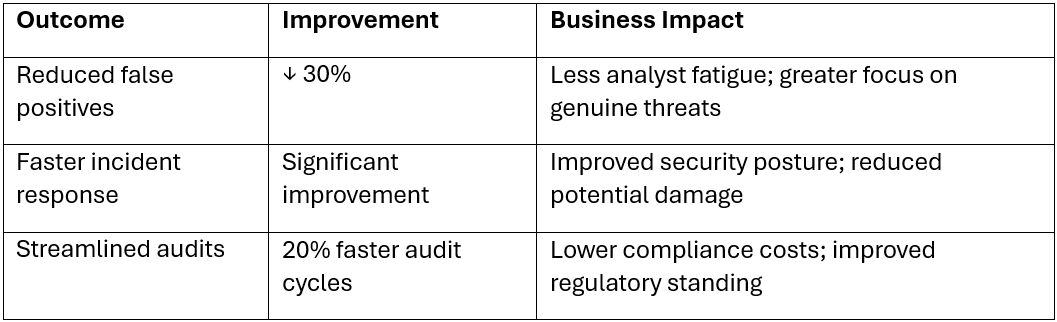

The Results: The compliance–driven overhaul produced unexpected operational benefits:

Crucially, the relationship with regulators shifted from adversarial to collaborative. Regulators praised the firm’s explainability approach as an industry benchmark.

Broader Insight: The firm’s experience highlights a crucial insight: regulatory mandates, initially perceived as operational burdens, can serve as powerful catalysts for improved performance. By reframing explainability as a core strength rather than a compliance constraint, the company enhanced both regulatory standing and operational effectiveness; demonstrating that compliance and performance are not opposing forces but strategic allies in building robust, trustworthy AI security systems.

Data Sovereignty: From Fragmentation to Global Advantage (challenge 2)

In another case, a global bank had long relied on a centralized global cybersecurity data lake to power AI–driven cyber analytics, enabling rapid threat detection across continents. But as strict data sovereignty laws started to emerge – first from EU's GDPR to China's stringent data regulations – the centralized data lake model faced serious regulatory and legal challenges. Initially, the cyber team feared that forced regional data fragmentation would severely weaken their threat detection capability as internal compliance teams began questioning the centralized SOC architecture.

The Strategic Pivot: Instead of resisting data sovereignty, the bank embraced it – redesigning its architecture into what it internally termed a “Sovereign Security Mesh.” This novel concept fused the principles of security mesh architecture with the realities of regional data sovereignty. The approach aimed to preserve global threat visibility while respecting local compliance mandates, creating a federated but collaborative security model. They established regional security hubs, each independently analysing data locally to comply with regulations. These hubs securely shared anonymized, aggregated threat insights with a global coordination platform, balancing local compliance with global threat visibility. As their Group Enterprise Architect summarized: "We created a federation of regional SOCs, each compliant yet collaboratively strong."

The Results: This compliance–driven redesign unexpectedly improved security and operational agility:

Moreover, localized threat modelling revealed nuanced regional threat patterns previously hidden in global datasets, significantly enhancing overall detection precision.

Broader Insight: The bank’s experience underscores a powerful truth: when approached strategically, compliance challenges can drive architectural innovation. By turning regulatory constraints into a catalyst for distributed security excellence, the bank not only addressed compliance obligations – it built a more resilient, adaptive global cybersecurity framework for today’s fragmented regulatory landscape.

Most compelling is how this approach evolves the principles of Cybersecurity Mesh Architecture (CSMA) – recognized by frameworks such as those from Gartner and NIST, which emphasize distributed controls, interoperability, and identity–centric trust zones. Introducing data sovereignty as a central design constraint pushes this paradigm further, adapting mesh architecture to meet the rising demands of data localization.

While “Sovereign Security Mesh” is not yet an industry standard, it represents an emerging architectural pattern. As more organizations pursue hybrid models that reconcile global visibility with regional compliance, this approach may well evolve into a reference model for cybersecurity in regulated environments

Broader Insight: The bank’s experience underscores a powerful truth: compliance challenges, viewed strategically, can drive architectural innovation. By turning regulatory constraints into a catalyst for distributed security excellence, the bank not only solved their compliance challenge—they created a stronger, more adaptive global cybersecurity framework designed explicitly for today’s increasingly regulated digital landscape.

Third-Party AI Governance: From Liability Risk to Strategic Advantage (challenge 3)

A European bank operating under a bancassurance model had partnered with third–party insurers to offer embedded insurance products across its retail channels. While this allowed the bank to scale its insurance offerings without directly underwriting risk, it also meant relying on external partners – and their vendors (creating 4th party dependencies) – for core services like policy issuance, claims triage, and fraud detection.

In one such partnership, the bank worked with an insurer using an AI–assisted SaaS platform to automate claims assessment and fraud detection – part of a growing trend across the insurance sector. These platforms, typically designed and operated by external vendors, offer efficiency and scale but introduce significant governance challenges around transparency, explainability, and accountability.

As regulatory scrutiny intensified, the bank recognized a critical blind spot: under GDPR and forthcoming AI regulations, organizations remain accountable for outcomes that affect customers – even when those decisions are made by third–party algorithms. In the eyes of the customer, it was the bank that bore the responsibility for unfair or opaque claims decisions – not the insurer, and certainly not the vendor behind the platform.

While this legal position is well established, it is often underappreciated in practice – especially as AI introduces new layers of complexity and distributed accountability. Recognizing this risk exposure, the bank shifted from a transactional vendor model to a strategic AI governance framework designed to ensure full oversight, auditability, and compliance across all external AI tools.

The Strategic Pivot: Acknowledging that accountability could not be outsourced, the bank established a cross–functional AI Governance Committee that brought together cybersecurity, compliance, legal, and procurement leaders. This wasn’t merely a policy update – it represented a fundamental overhaul of the organization’s Third–Party Management (TPM) model.

Too often, TPM and procurement operate in operational silos, disconnected from cybersecurity uplift efforts. As a result, general cyber risks – and AI–specific risks in particular – go unaddressed in vendor onboarding and lifecycle oversight. This governance pivot bridged that gap.

The committee introduced an advanced AI Vendor Assessment Framework – but the true innovation lay in execution. Rather than leaving evaluation to procurement alone, the bank embedded cybersecurity and AI experts directly into the vendor assessment lifecycle. Third–party platforms were now rigorously vetted across dimensions such as data governance, algorithmic transparency and explainability (AIX), model validation, bias mitigation, data loss prevention (DLP), and incident response readiness.

To operationalize this at scale, the team combined internal SME capability–building with targeted automation – leveraging RegTech tools to continuously monitor vendor systems, automate reassessments, and flag compliance drift in real time.1

Ownership of the framework remained with the AI Governance Committee, but implementation was distributed: cybersecurity led technical evaluations, legal enforced contractual safeguards, and procurement aligned onboarding and renewal processes with governance standards. This cross–functional integration transformed third–party risk management from a static procurement checklist into a dynamic, security–first discipline.

Explainability became especially critical – not just to satisfy regulators, but to enable internal teams to audit, understand, and defend AI–driven decisions made outside the organization. In a compliance environment where opacity equates to risk, AIX became a foundational requirement for defensibility and trust.

“This was a cultural shift as much as a technical one – transparency became our minimum standard for every AI system, internal or external.” – Chair, AI Governance Committee

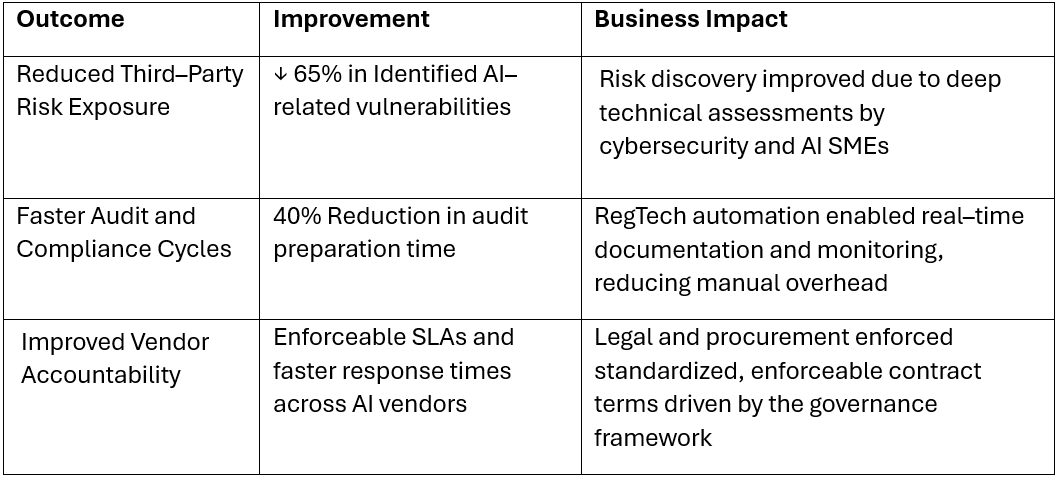

The Results: These improvements weren’t incidental – they were the direct result of embedding cybersecurity and AI expertise into third–party assessments, automating compliance oversight through RegTech tools, and enforcing standardized contractual safeguards. This proactive governance transformation yielded immediate and measurable business benefits:

While vendor reluctance was real at first, the company’s clear standards, contractual enforcement, and cross–functional engagement gradually overcame resistance. Over time, vendors recognized the strategic value of aligning with a forward–thinking client and began integrating these standards into their own governance practices, strengthening security on both sides of the partnership. The result highlights a broader truth: when approached strategically, governance uplift benefits everyone in the supply chain.

Broader Insight: This case highlights a growing imperative in the financial services and insurance sectors, where third– and fourth–party AI SaaS solutions are increasingly being deployed: strategic third–party AI governance is no longer a regulatory formality – it’s a business–critical capability. As banks and insurers rely more heavily on external platforms to deliver AI–enabled services, the line of accountability remains firmly with the organization that faces the customer.

By moving from a transactional vendor model to a strategic governance approach, the bank built a more secure, transparent, and resilient ecosystem – one where risk is distributed but accountability remains clear. In doing so, it transformed regulatory pressure into a foundation for trust, defensibility, and long–term competitive advantage.

Beyond Compliance: Strategic Imperatives for Business Leadership

When viewed through a strategic lens, AI regulatory compliance transcends mere regulatory adherence to become a catalyst for fundamental business transformation. The case studies we've explored reveal several powerful strategic insights that cross functional boundaries and offer lasting competitive advantage.

Trust as Strategic Currency in a Digital Economy

Where data breaches and AI mishaps can destroy trust and market value in an instant, trust has evolved from a soft value into perhaps an organization's most valuable strategic asset. Our case studies demonstrate how companies that proactively embed compliance into their operations – whether through explainability, fairness testing, or rigorous third–party governance – manage to create unprecedented levels of stakeholder trust. This trust manifests as tangible business value: accelerated customer acquisition, premium pricing power, stronger investor confidence, and enhanced talent attraction. Far from being merely a compliance exercise, transparent and ethical AI deployment represents a foundational strategy for market leadership in an increasingly sceptical digital marketplace.

Organizational Resilience Through Integrated Governance

The organizations in our case studies that approached compliance strategically didn't simply bolt on governance processes. They fundamentally rewired their operational DNA. By embedding governance at every level, from AI development pipelines to vendor management frameworks, these companies developed an intrinsic organizational resilience. This compliance–integrated approach allows the organisation to rapidly adapt to changing regulatory environments while simultaneously reinforcing business continuity, reducing operational vulnerabilities, and enhancing decision–making quality. The strategic value isn't just in meeting today's compliance requirements, but in building inherent adaptability; thus developing a whole new set of competitive advantages.

Value Creation Through Ethical AI Leadership

Perhaps most significantly, our case studies reveal how ethical AI leadership actively creates business value rather than merely preserving it. Whether through the fintech's enhanced investment valuation or the healthcare provider's reduced liability costs, proactive compliance consistently unlocks measurable financial returns. These companies demonstrate that ethical AI isn't a cost centre but a value generator. One that creates competitive differentiation, drives innovation through constraint, attracts premium partnerships, and opens markets that remain closed to less trustworthy competitors. In essence, ethical AI leadership transforms compliance from a liability into a strategic asset class with compounding returns.

Making Strategic Compliance a Reality – Practical Implementation Strategies

To transform the strategic imperatives of trust, resilience, and value creation into organizational reality, cybersecurity leaders need practical implementation approaches. The following strategies provide a roadmap for embedding compliance into your operations in ways that directly support these strategic objectives.

Understanding the strategic benefits of proactive AI compliance is only the first step. To fully realize these advantages, cybersecurity leaders need practical, actionable strategies to embed compliance effectively within their operations. Below, I outline four proven approaches that leading organizations have successfully adopted – see these as starting points and not an exhaustive list.

Leveraging these strategies, your company will be able to ensure that compliance becomes integrated deeply into the organization's cybersecurity DNA, rather than being treated as an afterthought.

1. Adopt "Compliance by Design" from Day One

Don’t retrofit compliance into existing systems; embed it into the AI services lifecycle from the outset. This means involving cybersecurity, compliance, legal, and data science teams together at the initial stages of AI model development. Clearly define transparency, explainability, and fairness standards early, and rigorously enforce them throughout the AI design, training, and deployment phases.

Actionable Steps:

Develop an AI compliance checklist to guide early-stage model development.

Require that all new AI cybersecurity initiatives include explicit compliance impact assessments before approval.

Establish structured cross-functional collaboration from the outset—engaging stakeholders across cybersecurity, engineering, procurement, legal, and compliance to ensure AI systems are designed with shared accountability and holistic oversight..

2. Establish Cross-Functional AI Governance Committees

Break down operational silos by creating a standing governance body specifically dedicated to AI compliance. Include stakeholders from cybersecurity operations, compliance, legal, data governance, procurement, and risk management. These committees become the backbone for ongoing vendor evaluations, policy development, compliance oversight, and quick adaptation to regulatory changes.

Actionable Steps:

Define clear governance objectives, roles, and decision-making authority in the committee charter.

Schedule regular committee sessions focused on AI risk exposure, vendor oversight, and regulatory alignment.

Integrate the committee's outputs into broader enterprise risk and compliance workflows to ensure AI-related risks are addressed holistically – not in isolation.

3. Leverage Automation and RegTech Tools

Meeting regulatory demands often creates significant administrative overhead—but AI itself can help close that gap. Modern Regulatory Technology (RegTech) solutions now offer practical ways to streamline compliance documentation, monitor third-party risk, validate model behavior, and detect emerging compliance issues in real time.

Actionable Next Steps:

Pilot automated compliance documentation and audit tools in high-impact areas such as SOC alerts, third-party vendor monitoring, and AI explainability reporting.

Integrate real-time compliance controls into AI model testing and deployment pipelines—ensuring issues are flagged before reaching production.

Evaluate RegTech platforms that support ongoing monitoring, governance dashboards, and policy mapping aligned to frameworks such as GDPR, NIST AI RMF, and the EU AI Act.

4. Proactively Engage with Industry Standards and Regulatory Bodies

Rather than passively responding to regulatory change, leading organizations shape the compliance landscape through proactive engagement. Participating in standards-setting bodies (e.g., NIST, ISO, and sector-specific forums) allows companies to anticipate emerging requirements, influence policy direction, and align industry guidance with operational realities.

Actionable Next Steps:

Assign internal experts to participate in relevant working groups, advisory panels, or regulatory consultations on AI governance and cybersecurity.

Contribute to public dialogue by publishing insights, case studies, or position papers that advocate for practical, risk-based approaches to AI compliance.

Track and map emerging regulatory frameworks (e.g., EU AI Act, DORA, NIST AI RMF) to organizational capabilities—and ensure the necessary skills and ownership are distributed across cybersecurity, compliance, legal, and engineering functions. This positions your teams to lead, not lag, as regulations evolve.

Leading from the Front – Compliance as Competitive Advantage

Viewing compliance as a mere obligation is no longer sustainable. Organizations that approach it strategically are unlocking measurable value – across trust, agility, and risk resilience. As demonstrated throughout this article, companies that proactively embed compliance into their cybersecurity practices can transform regulatory burdens into strategic advantages – enhancing trust, increasing operational agility, and reducing long-term risk.

Visionary cybersecurity leadership recognizes that compliance isn’t a distraction – it’s a lever. Since opting out of regulation isn’t an option, the smart move is to adopt a compliance-first mindset – supported by strategies like Compliance by Design, cross-functional governance, automation, and proactive engagement with evolving standards. These aren't just best practices – they're enablers of sustained competitive advantage in a regulatory environment that will only become more complex.

The message is clear: compliance doesn’t have to slow your business down. It can help drive it forward – enabling stronger security, deeper stakeholder trust, and greater resilience against both cyber threats and regulatory uncertainty.

How is your organization approaching AI compliance today? Are you still viewing it as a checkbox exercise, or are you seizing it as a strategic opportunity? Let’s continue the conversation – because in a world where innovation is constant, leadership must come from the front.

In the next article of this series, we’ll examine why this strategic approach to compliance becomes even more critical when confronting the next frontier: adversarial AI. As machine learning systems are weaponized against the very defences designed to protect us, only those organizations that have embedded compliance into their operational DNA will be able to detect, respond to, and adapt to these evolving threats – while staying on the right side of the regulatory line.

While specific solutions used remain confidential, there are several widely adopted RegTech platforms that support similar functions, including OneTrust (third–party risk and AI governance), LogicGate (customizable GRC workflows for AI systems), and TrustArc (automated privacy and AI impact assessments). These tools typically support continuous monitoring, explainability documentation, model risk workflows, and vendor lifecycle compliance aligned with frameworks such as GDPR, NIST AI RMF, and the EU AI Act.